The TEN Capital Network Program introduces your deal to our network of accredited investors.

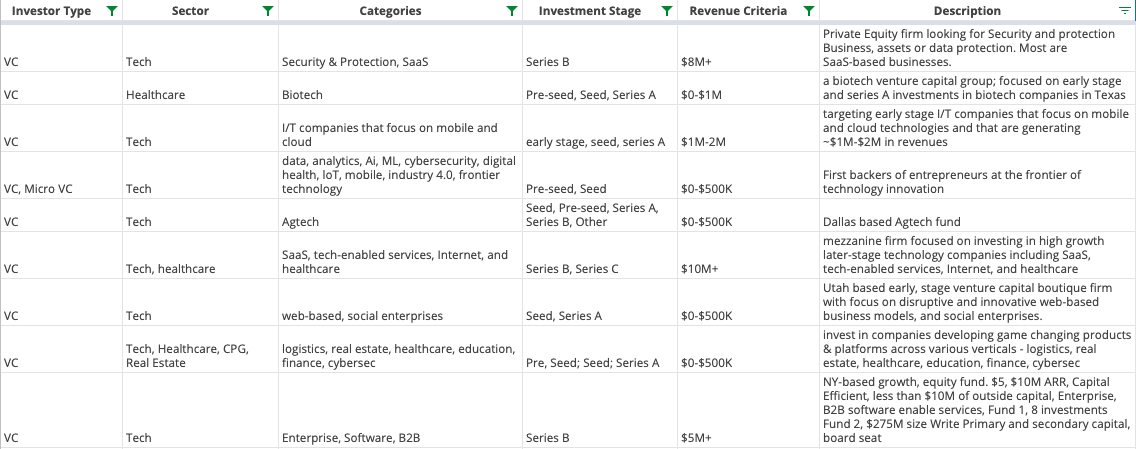

We approach those who are most relevant to your revenue, sector, and stage:

How the TEN Capital Network Program Works

We focus on Seed, Series A, and Series B raises. Most Seed raises are from $500K to $750K, Series As are from $1M to $5M, and Series Bs run between $5M and $20M.

Typically, our angels write $50K checks, our High Networth Individuals write $100K checks, our Family Offices write $250K checks, and our VCs write $250K to $1M checks on the first round.

We’ll take your pitch deck and build out an introduction from TEN to the investors. If you do not have your pitch deck prepared, we can assist with that as well as a part of our premium program.

We will strategically source investors for your deal weekly throughout the course of your campaign and educate those following your deal through regular updates and webinars.

Most campaigns will run between 3 and 6 months as investors have their due diligence to run.

When you’re ready to start with the TEN Capital Network, we’ll send you a signup email and then, with your input, we’ll start work on your communications to the investors

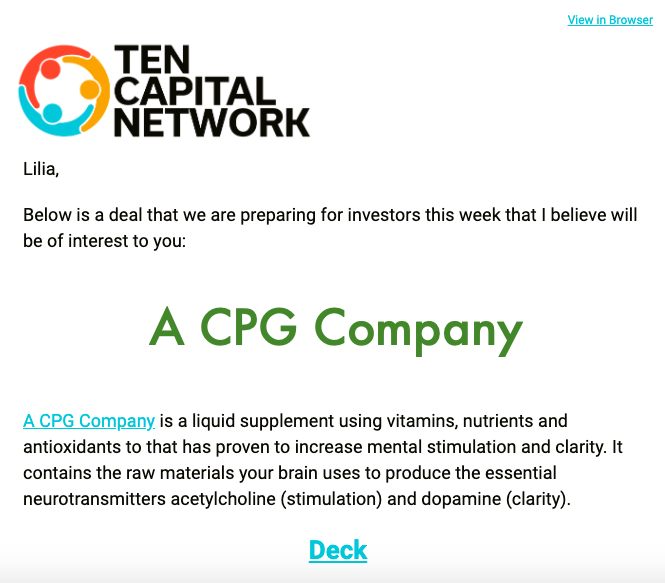

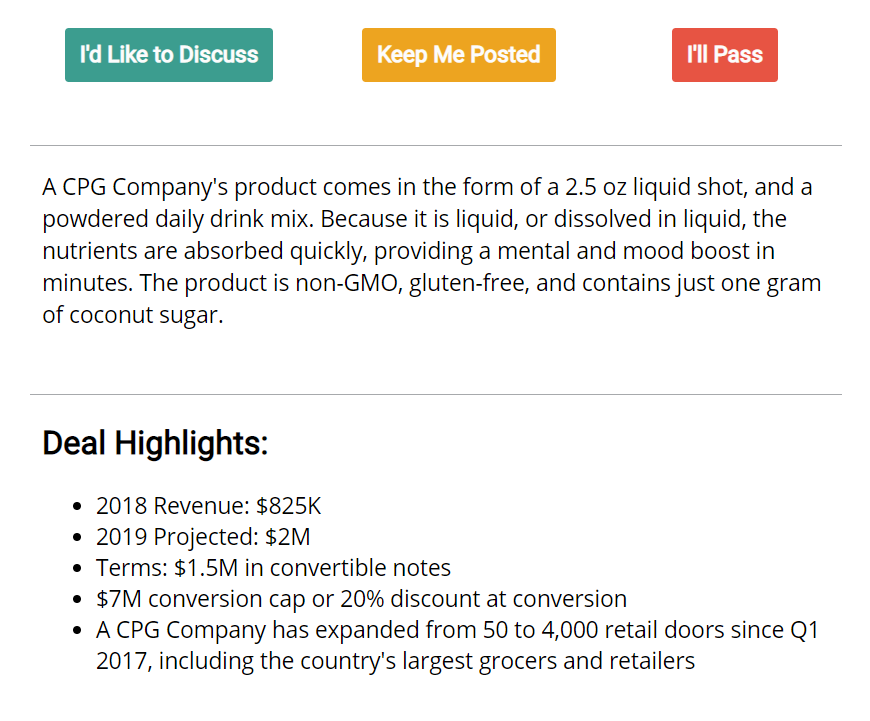

Introducing Your Deal:

We introduce your deal to our investor network, providing a brief description and a link to your most recent deck

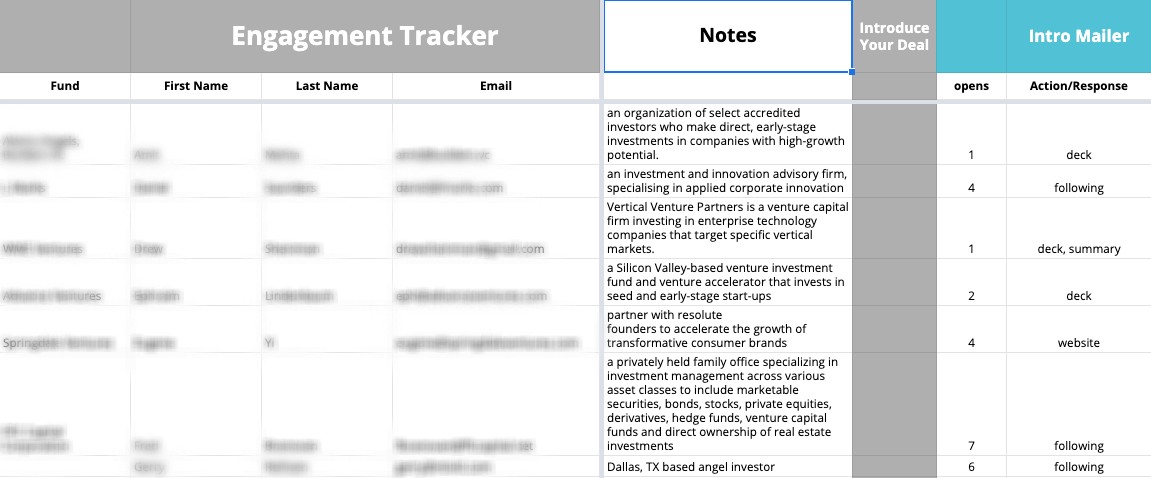

Those expressing interest are put into a list of “followers” that we will keep track of throughout your campaign in a provided “Engagement Tracker”:

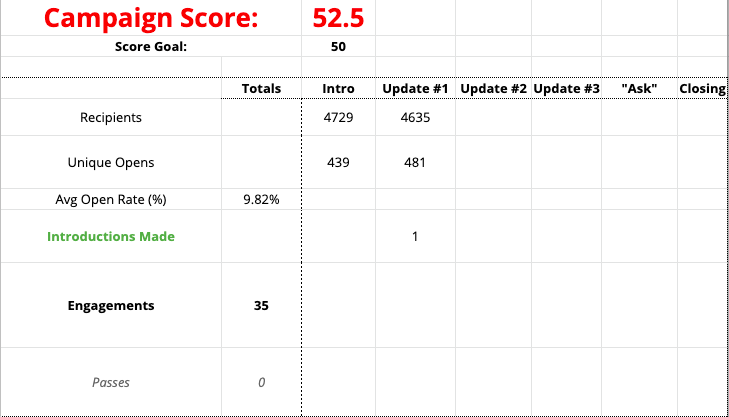

We will also track the progress of your campaign as a whole in your Worksheet:

We will continue to regularly introduce your deal to investors in our network based on their criteria and yours. We will keep track of those we are engaging with each week in your Engagement Tracker.

Webinars & Events:

During the course of your campaign, we will also run webinars to showcase your deal:

We will facilitate online meetings with your current investor followers as well as group webinars to introduce you to new ones:

Marketing Materials:

Throughout the course of your campaign, we will create for you various pieces of marketing materials that are yours to keep.

This includes a series of investor materials including a “Why I Invested” featuring one or more of your lead investors, a Case for Investment, and a Sector Analysis to send to the investors. Each will be captured as mailer templates, audio and video recordings, pamphlets, PDFs, and more.

We’ll also schedule an interview with you for our Investor Connect podcast to capture your story.

Closing the Investors:

Once we have a campaign close date, we run a “Case for Investment” mailer to close those investors who have been following the deal:

We include your pitch deck, terms sheet, and data room. If you have these documents we’ll use it. If you need help we’ll work with you to build it out: