2 min read As we take a look at the 2020 year in review, we see a year of change, uncertainty, and challenges.

It was a transformational year when business shifted online, everyone spent more time with their family, commuting to work became a thing of the past, and much more. At TEN Capital Network, we overcame the challenges through the strength of our team working together. Here are a few highlights from our 2020:

TEN Capital in 2020

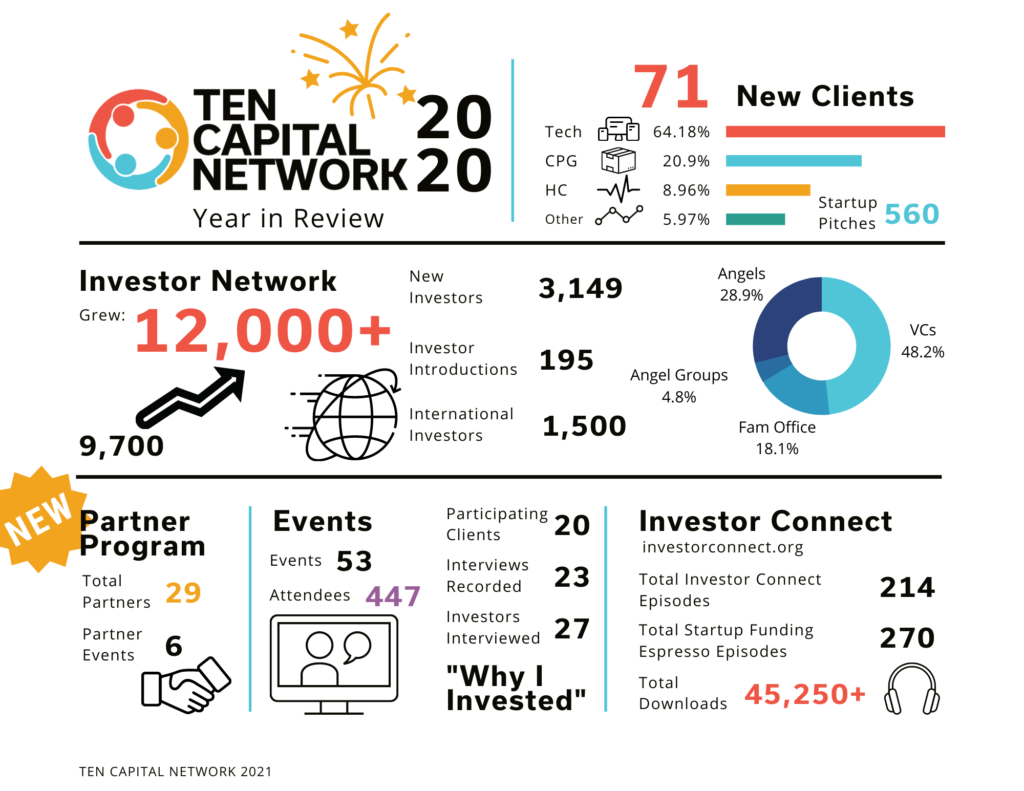

Since January of this year, we gained 71 new Clients out of 560 Startup pitches.

We started the year with 9,700 investors and are heading into 2021 with over 12,000. Our investor network includes VCs, Angels, and Family Offices, each investing in the Tech, Healthcare, CPG, Energy, and a variety of other spaces.

Events Moving Online

We started 2020 with 7 successful in-person events but shifted quickly online to round out the year with a total of 53 events, hosting 447 total attendees.

We also began a brand new series called “Why I Invested.” In each virtually recorded interview, we speak to investors who have previously invested in one or more of our client’s deals. We hear their perspective on what they like about the deal and why they decided to invest. To date, we have had 23 episodes recorded with 27 participating investors and counting.

NEW! TEN Capital Partner Program

In 2020, we launched theTEN Capital Partner Program. Our Partners have become a big part of our startups’ success through Alternative Funding, Crowdfunding, Accounting, Back Office Services, and so many more.

Inaugural partners include Arora Project, Investable Mastermind, Kickfurther, Title3Funds, INNP Consulting, CrowdVision Advisors, LLC, and Wiss Early Stage.

NEW! Podcast Series From Investor Connect

In May of 2020, TEN Capital’s Podcast series Investor Connect introduced a brand new show: Investor Perspectives.

In each episode of this informative series, Host Hall Martin discusses a chosen, relevant topic with experienced investors from the TEN Capital network.

This year we have published a total of 240 Investor Connect episodes and 270 Startup Funding Espressos.

In the fall, our Startup Funding Espresso podcast program became a #DailyShot newsletter, delivered daily, directly to your inbox. Each weekday we send out tips and advice for investors and startups alike, each based on our popular podcast series (you can sign up for the #DailyShot newsletter here).

Top 10 Investor Connect Episodes of 2020:

10. Episode 319 – Jyri Engestrom of Yes VC

9. Episode 341 – Manuk Hergnyan of Granatus Ventures

8. Episode 442 – Sarah Jennings of Beyond Angels Network Yellow Jacket Fund

7. Episode 367 – Xavier Segura of Tessera Venture Partners

6. Episode 358 – Samy Eissa of Hit Ventures

5. Episode 373 – Charles Sidman of ECS Capital Partners

4. Episode 347 – Maggie Sprenger of Green Cow Venture Capital

3. Episode 388 – David Wadler of Vendorful, Inc.

2. Episode 383 – Randy Myer of Carolina Angel Network

1. Episode 404 – Chelsea Burns of Escaladora Ventures

From the TEN Marketing Department

While we had a lot of great content in 2020, there were a few standouts based on feedback from the network:

Top 10 Blog Posts for 2020:

9. The Importance of Non-Financial Factors in Setting Valuation

6. Building Investor Engagement

5. Fundraising Metrics That Matter

4. Your Fundraising Growth Story Pt. 1

3. A Note on Convertible Notes

2. What is the Real Due Diligence Process?

Top 5 eGuides of 2020:

4. The Impact of Covid on Cannabis Market

2. Term Sheets

1. Investor Perspectives on Healthcare Trends post-COVID

From all of us at TEN Capital (Sam, Ashley, Lilia, Caitlin, and Hall), we hope you have a healthy, happy, and prosperous 2021.

Hall T. Martin is the founder and CEO of the TEN Capital Network. TEN Capital has been connecting startups with investors for over ten years. You can connect with Hall about fundraising, business growth, and emerging technologies via LinkedIn or email: hallmartin@tencapital.group